Healthcare expertise can help insurers win the “undecided vote” this season

The research is a result of a survey among 2,000 U.S. adults conducted online in September 2016 by Harris Poll on behalf of Xerox.

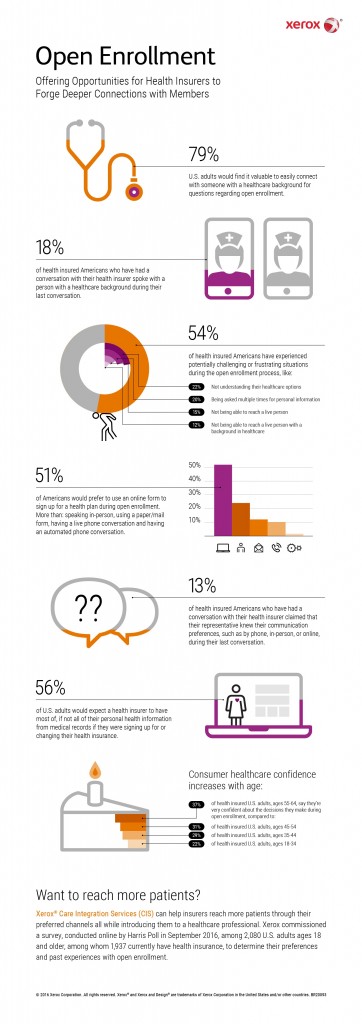

In addition, nearly a quarter (22 percent) of Americans who plan to participate in open enrollment this year – which for many lasts from Nov. 1, 2016 to Jan. 31, 2017 – have not decided which coverage plan they will select. Moreover, nine percent admit they are not sure because they don’t understand their options and 24 percent admit they have felt frustrated with the overall open enrollment process.

“Offering access to healthcare professionals is one way insurers can grab their share of the undecided votes this open enrollment season – both by retaining current and adding new members,” said Connie Harvey, chief operating officer, Xerox Healthcare Business Group. “Consumer expectations for meaningful communication is ever increasing and putting significant strain on health insurers to meet the unique challenges of the consumer.”

Xerox’s Care Integration Services (XCIS) helps insurers by providing a holistic view of all relevant member data for healthcare professionals who are fielding member calls. The solution allows professionals to have easily searchable and relevant member data at their fingertips, allowing them to best answer individualized member questions from open enrollment through the onboarding process.

This not only improves the member experience, but also promotes overall member health by allowing insurers to identify conditions early on via pinpointed risk factors, assist members in managing of chronic medical conditions and maintain overall wellness by providing individualized health itineraries.

Access to Health Information is Lacking

The research also found that over half of Americans (56 percent) expect a health insurance representative to have most or all of their personal health information from medical records on hand if they were signing up or changing health insurance. Yet, only 19 percent of health insured Americans who have had a conversation with their health insurer said the representative was prepared with this information during their last conversation.

“Health insurers are missing the mark because they aren’t ready to answer questions when the consumer calls,” said Harvey. “With a little preparation they could be winning those undecided customers over to their health plan.”

Overall, only 51 percent of health insured Americans who have had a conversation with a health insurance representative were satisfied with the interaction or outcome of the conversation with their insurer.

Other key survey results include:

- Twenty-three percent of Americans who have health insurance do not feel confident that they are making the best choice for themselves and/or their family when selecting health insurance.

- More than half (51 percent) of Americans would prefer to sign up for health insurance through online forms, while only one in 10 would choose paper-based solutions (11 percent) or via the phone (10 percent), and one in five would prefer in person (23 percent).

- The top things Americans who plan to participate in 2016 open enrollment will look at when making a decision on health insurance are the monthly premium prices (63 percent); co-pays/co-insurance (52 percent) and deductible amount (50 percent.)

2016 Xerox Services Consumer Open Enrollment Survey was conducted online within the United States by Harris Poll on behalf of Xerox from September 13-15, 2016 among 2,080 U.S. adults ages 18 and older, among whom 1,937 currently have health insurance. This online survey is not based on a probability sample and therefore no estimate of theoretical sampling error can be calculated. For complete survey methodology, including weighting variables, please contact Erin Isselmann, erin.isselmann@xerox.com.

Xerox Healthcare helps healthcare organizations focus on improving lives through better, more affordable and accessible care by designing processes that work for the people delivering, enabling and receiving care.