Survey: Consumers Divided on Whether Health Plans Are Partners or Payers

A recent study by HealthEdge highlights evolving consumer perceptions of health insurance, revealing both opportunities and challenges in how health plans are viewed and how digital tools—especially artificial intelligence (AI)—are shaping member engagement.

The fifth annual Healthcare Consumer Report, based on a survey of over 4,500 U.S. health plan members, shows a notable shift in how individuals relate to their insurers. Just over half of respondents (51%) now see their health plan as a partner in their care, rather than solely as a payer of medical bills.

Partner vs. Payer: Impact on Satisfaction

The way consumers view their health plan directly affects their satisfaction and loyalty. Those who see their plan as a care partner report significantly higher satisfaction rates.

- 78% of those who consider their plan a partner are satisfied with the personalized experience.

- In contrast, only 49% of those who view their plan as just a payer report similar satisfaction.

“Consumers want more choice in their health coverage – and they’re getting it as the market shifts,” said Alan Stein, Chief Product & Strategy Officer at HealthEdge. “This demand is pushing payers to evolve into more consumer-centric organizations, offering experiences that resemble those in the retail space.”

Affordability Still the Top Concern

Despite the shift toward more personalized experiences, cost remains a key factor for most consumers when choosing or leaving a plan.

- 42% would stay with their current plan due to affordable monthly premiums or out-of-pocket costs.

- 43% said high costs would drive them to leave.

Interestingly, individuals who see their plan as a partner are less likely to cite cost as a deciding factor:

- Only 16% cited premiums as a reason to switch (compared to 25% of those who view their plan as a payer).

- Only 19% cited out-of-pocket costs (versus 28%).

Digital Engagement and AI Adoption

The report also found a rise in digital engagement, though awareness and adoption of AI tools remain limited.

- 78% have used or plan to use their health plan’s mobile app, up from 64% last year.

- However, 79% say they either haven’t used (58%) or don’t know if they’ve used (21%) AI-powered tools.

Still, there is openness to future use:

- 64% would be willing to try tools like chatbots or AI-driven cost-saving features.

- Top concerns include:

- Quality and accuracy (26%)

- Privacy (20%)

- Data security (20%)

- 30% said their confidence would increase if health plans were transparent about how and when AI is used.

Declining Satisfaction with SDOH Support

The report also noted a continued decline in satisfaction with how care managers support social determinants of health (SDOH).

- Only 33% of consumers assigned a care manager are fully satisfied with support for economic needs, down from 36% in 2024 and 38% in 2023.

- The same percentage (33%) are satisfied with assistance for essentials like housing, food, and utilities—also a drop from previous years.

Other Key Findings

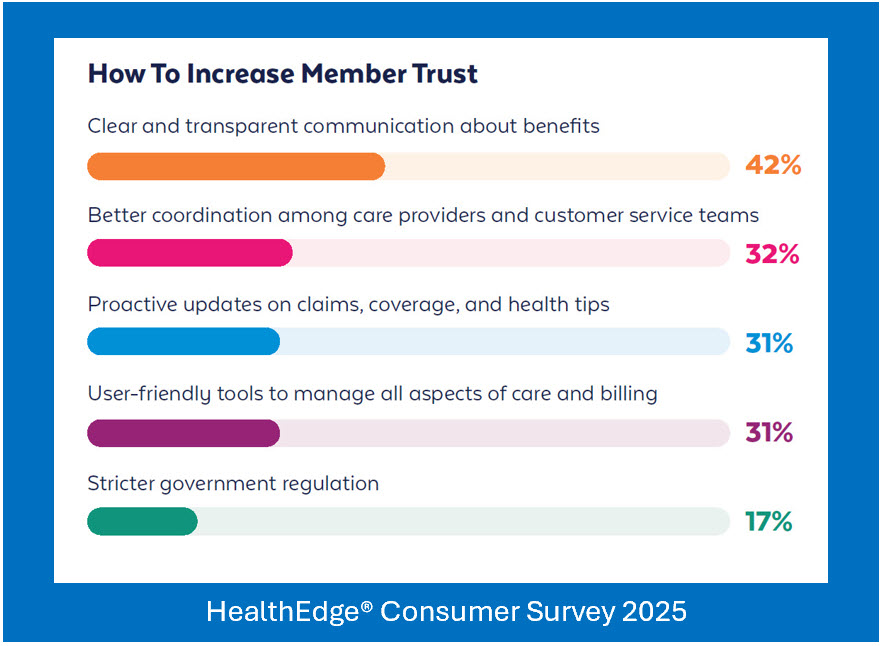

- Trust remains elusive: 17% of consumers said they wouldn’t trust their health plan, regardless of actions taken.

- Clear communication matters: 42% cited transparency about benefits as the most effective way to build trust.

- Interest in ICHRA: 60% of those with employer-based insurance would consider an Individual Coverage Health Reimbursement Arrangement (ICHRA) if offered, allowing them to shop for their own coverage.

- Blame for system inefficiencies is nearly evenly split between the government (36%) and health insurers (32%).

Survey Methodology

The Healthcare Consumer Report is based on a May 2025 survey of over 4,500 U.S. health plan members, representing a broad cross-section of demographics, health conditions, and insurance types.

The full report, From Payers of Claims to Partners in Care: The 2025 Healthcare Consumer Study, is available at HealthEdge.