Insights from the second edition of Salesforce’s Connected Health Consumer Report show that trust is much more than a nice-to-have — it is becoming a necessity across all health sectors

In Salesforce’s most recent Dreamforce keynote, Salesforce Chairman and co-CEO Marc Benioff outlined his thoughts on a critical question, “How do we create more trust?”

According to Benioff, the world is currently undergoing a crisis of trust, and every organization must act. Indeed, Edelman’s 2021 Trust Barometer found that in the last year, trust has dipped across nearly every single industry sector— including healthcare. The cost of trust within healthcare and life sciences industries is especially high, where trusted relationships can be the difference between being vaccinated and unvaccinated, wellness or illness, and even life or death.

To better understand the role of trust within these critical industries, and what trusted health organizations are doing differently, Salesforce surveyed over 12,000 consumers in 13 countries and developed the latest edition of its Connected Health Consumer Report.

Consumer trust looks different within each health sector

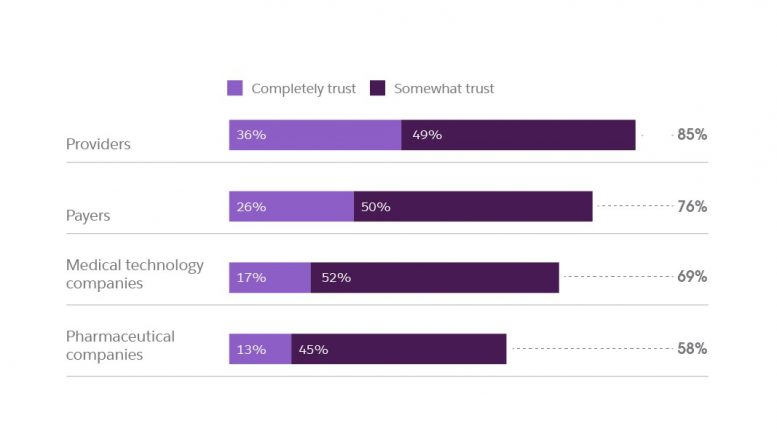

While the pandemic impacted healthcare and life sciences companies across the board, consumer trust in 2021 varies by sector. As the daily applause for healthcare workers may have indicated, care providers lead the pack in consumer trust, with 85% of consumers saying they somewhat or completely trust their providers.

Although pharmaceutical companies developed incredible innovations during the pandemic, including the release of the first FDA-authorized mRNA vaccines, pharmaceutical companies found themselves at the low end of consumer trust. Only 58% of health consumers trust the pharmaceutical companies they interact with. And even fewer — one in 10 consumers with a prescription — completely trust pharmaceutical companies.

Trust influences consumer behavior and interests

Of course, trust is more than a “nice-to-have” — it is linked to specific, desirable consumer behaviors. Salesforce’s study found that consumers who have a trusted relationship with a given health organization are much more willing to share relevant, non-medical information such as nutrition habits or access to transportation. This holds true across insurers, providers, medical technology companies, and pharmaceutical organizations, with a particularly stark difference within the pharmaceutical space.

Moreover, when compared to consumers who don’t trust pharmaceutical companies, consumers with trusted relationships express significantly more interest in using different health services, such as reminders to take medicine or enrolling in patient support programs.

For example, 71% of patients with prescriptions who completely trust pharmaceutical companies are interested in getting information about their disease or condition from a pharmaceutical company, compared to only 27% of patients with prescriptions who don’t trust pharmaceutical companies. Many would prefer to turn to their physicians, families — even social media — for direction. The fact remains that 48% of consumers today feel the health industry prioritizes its own needs over that of its end customers

This is also why building relationships across multiple channels — such as pharma reps engaging with healthcare providers — is critical. According to Liz Theophille, Chief Technology Transformation Officer at Novartis, “digital engagement with healthcare providers is important particularly in light of COVID-19 accelerating acceptance of technology in arenas that previously were uncharted.” Being able to build relationships with consumers across channels is all part of today’s new trust landscape.

Trusted health companies address the whole person

Health is more than your blood pressure or body mass index. Socioeconomic status, access to transportation, nutrition habits, and health literacy — all examples of social determinants of health — also factor into health outcomes.

Organizations that personalize services in response to an individual’s medical and non-medical health factors are met with increased consumer trust. For example, Salesforce’s research found that compared to providers with lower consumer trust, trusted providers are twice as likely to ask patients about non medical needs impacting health. This indicates that to continue building trust, it’s important for health organizations to gain a holistic understanding of the consumers they serve.

Indeed, 97% of consumers say it’s important for their providers to follow up on their progress — even amid disruption.