$300M Series D to fund continued growth of innovative virtual care solutions

Dr. Omar Ishrak Appointed Biofourmis Chairman

Biofourmis, a global leader in virtual care and digital medicine, today announced it has surpassed unicorn status with a $300 million Series D investment led by leading global growth equity firm General Atlantic. CVS Health (NYSE: CVS) and existing investors also participated in the round, which will help fuel the company’s next phase of growth. Biofourmis also announced that former Medtronic CEO and Chairperson at Intel, Dr. Omar Ishrak, will join the company’s Board of Directors as Chairman.

With this investment, Biofourmis plans to scale up its virtual care offerings. This includes delivering personalized and predictive in-home care to a growing number of acutely ill patients and expanding its recently announced virtual specialty care services, Biofourmis Care, to those patients with complex chronic conditions. In parallel, Biofourmis plans to fund clinical trials to advance the development of digital therapies that work in conjunction with high-value drugs to improve efficacy, while forming strategic partnerships with companies in the digital health and virtual-first care ecosystems. Through these relationships, Biofourmis plans to accelerate the growth of its virtual care platform, Care@Home, which enables providers and payors to remotely manage patients across the entire care continuum.

Biofourmis also aims to use the funding to continue strengthening its position in the value-based care market. Value-based care ties payments to quality of care and patient outcomes, rewarding providers for efficiency and effectiveness. According to McKinsey, $265 billion worth of care services for Medicare FFS and MA beneficiaries could shift from traditional facilities to the home by 2025, creating value for multiple parties, including care at home providers and technology companies.

Long touted as a technology that’s “going to break through tomorrow,” traditional remote patient monitoring (RPM) solutions have fallen drastically short of patient needs, often focusing on ‘monitoring’ as opposed to the proactive ‘management’ of patient populations. As a result, while clinical care teams glean information, they are typically left with few insights and almost no actionable clinical interventions. Because traditional RPM solutions tend to fail to view patients as unique subjects, alarm burden and fatigue are commonplace, as they focus on comparing a patient’s vitals to norms of the population at large and subsequently informing clinicians of warning signs. Furthermore, traditional solutions do not include licensed health professionals who can provide high-quality clinical care to improve patient outcomes and reduce the total cost of care.

Long touted as a technology that’s “going to break through tomorrow,” traditional remote patient monitoring (RPM) solutions have fallen drastically short of patient needs, often focusing on ‘monitoring’ as opposed to the proactive ‘management’ of patient populations. As a result, while clinical care teams glean information, they are typically left with few insights and almost no actionable clinical interventions. Because traditional RPM solutions tend to fail to view patients as unique subjects, alarm burden and fatigue are commonplace, as they focus on comparing a patient’s vitals to norms of the population at large and subsequently informing clinicians of warning signs. Furthermore, traditional solutions do not include licensed health professionals who can provide high-quality clinical care to improve patient outcomes and reduce the total cost of care.

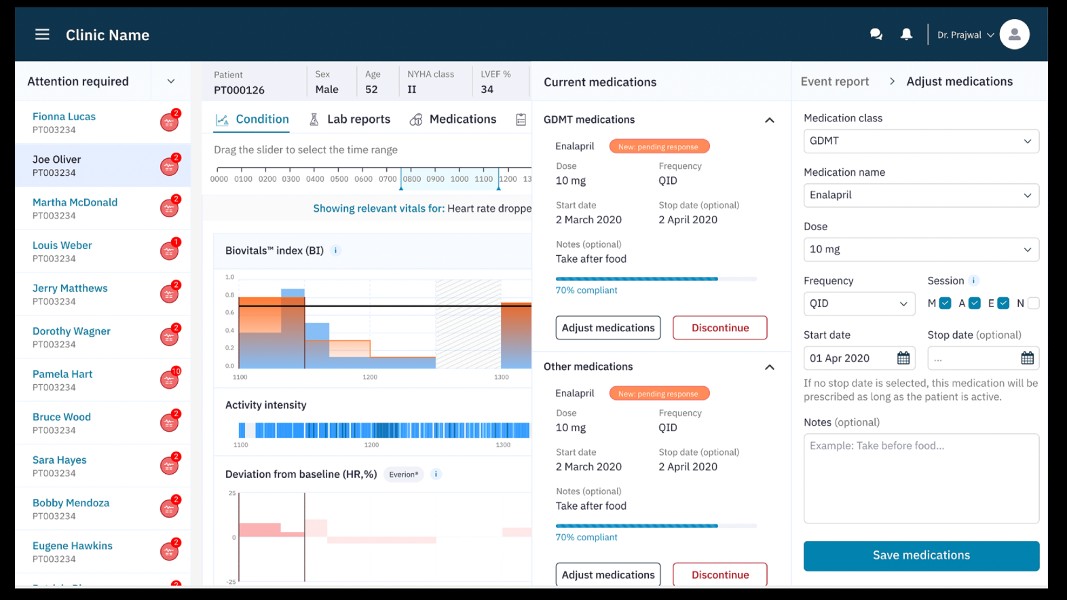

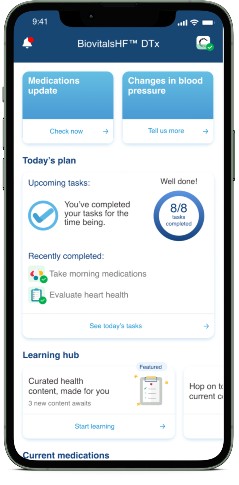

Biofourmis solutions instead use a blend of passive inputs via continuous monitoring devices, active inputs from episodic monitoring devices, and patient feedback on activity driven through the Biofourmis app to get a complete picture of the patient’s status. Designed to be used at home, in acute, post-acute, and chronic care, Biofourmis’ game-changing solution compares the patient as they are today to their normal state. Leveraging its core expertise in data science and novel biomarkers, Biofourmis can detect clinical deterioration early on and offer dynamic care pathways that guide therapeutic interventions. The device- and sensor-agnostic solutions use artificial intelligence (AI) and advanced FDA-approved analytics to dynamically monitor patients, establish personalized baselines, and reduce false positives. Through its 24/7 virtual clinical care team, Biofourmis’ licensed health professionals can promptly confirm and respond to these alerts while communicating medication changes and updated care plans with primary care teams to ensure patient care is well coordinated.

“In recent years, we have seen a significant trend towards virtual at-home care, which has become a critical alternative to in-person care, particularly as digital adoption continues to accelerate,” said Sandeep Naik, Managing Director and Head of India & Southeast Asia at General Atlantic. “Biofourmis is tapping into this global trend with a new approach to remote care management.”

Robbert Vorhoff, Managing Director and Global Head of Healthcare at General Atlantic, added, “We believe Biofourmis is differentiated by technology solutions underpinned by its deep clinical research. Beyond providing key patient health insights to health systems, Biofourmis is also driving personalized treatment and better outcomes.”

Biofourmis’ app drives high patient engagement and compliance resulting in hospitals experiencing a 70% reduction in 30-day hospital readmissions and reduces the cost of care by 38%, all without impacting the quality of care.

“We are excited to partner with General Atlantic, which shares our vision for the future of virtual care and the urgency to bring the Biofourmis solution to customers and patients across the globe,” said Kuldeep Singh Rajput, Founder & Chief Executive Officer of Biofourmis. “We are also thrilled to have Dr. Ishrak join our board. His vast experience, which includes leading one of the world’s most successful medical technology companies, will be an incredible asset as we look to take our business to the next growth phase.”

“I’m thrilled to join Biofourmis as Chairman of the Board at this exciting time in the company’s rapid rise as a leading innovator in virtual care and digital medicine,” Dr. Ishrak said. “Biofourmis continues to push the boundaries as it evolves virtual care from reactive to predictive models that deliver continuous care and better health outcomes to patients while improving efficiencies and lowering costs for healthcare organizations. It’s a win-win that is a true differentiator in the market.”

To date, Biofourmis has raised a total of $445 million in funding. Existing investors include SoftBank Vision Fund 2, Openspace Ventures, MassMutual Ventures, Sequoia Capital and EDBI.